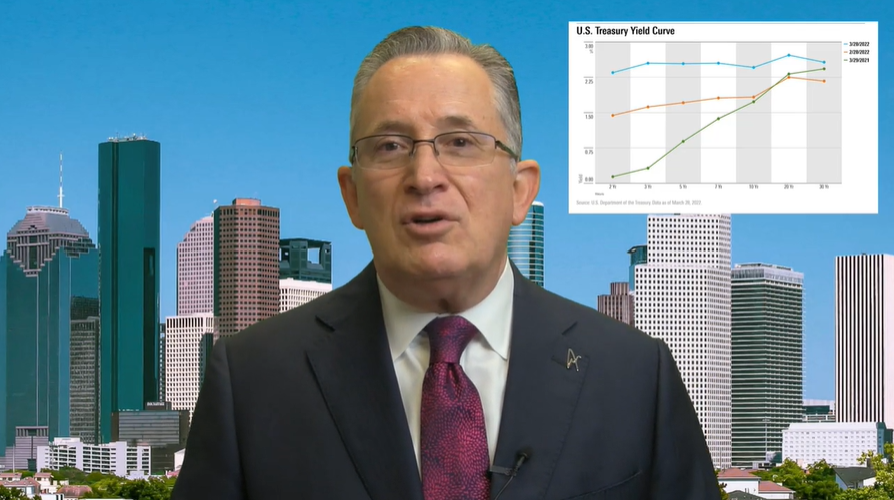

We've got a new jobs report and an inverted yield curve. How is that going to change things this year? Yesterday's jobs report announced a 3.6% unemployment rate. Now that's remarkable in any time. In the United States, a large country, that's just 6 million people unemployed. To put this in perspective, there are 11.3 million job openings in the country right now. What does that mean? That translates into what has proven to be a red hot job market, like nothing we've ever seen before. Now interestingly, there's another almost 6 million people who are out of work, but not looking. And if you do the math, the unemployed, the out of work not looking, and the job openings match almost perfectly. The challenge is getting them back, and a large part of the challenge is a lot of those unemployed are young mothers, young families, or other…

Read More

Recent Comments