The Bigger Problem: Budget Reality and Investor Impact

Here’s the truth: the real waste in agencies like Medicare and Social Security is statistically low, lower than in much of the private sector. Ironically, we now spend more trying to root out inefficiencies than the waste itself is worth.

The fallout?

-

Declining global confidence

-

A weakening U.S. dollar

-

Less trust in our institutions

DOGE may slowly fade into irrelevance, possibly reverting to its original regulatory role under a more appealing name. But the deeper issues it brought to light remain, and they matter to you as an investor. From tax enforcement to economic forecasting, these policy decisions shape the landscape in which we build portfolios and manage risk.

So what exactly happened with DOGE, and what can it teach us?

A Case Study in False Efficiency

Like many of you who travel, I’ve been watching the chaos unfold at Newark Airport. Staffing shortages. Tech meltdowns. It’s a mess. But it’s not just bad luck, it’s the result of chronic underfunding and short-sighted policy.

This sparked a bigger question in my mind: Can government spending cuts actually cost us more than they save?

Let’s explore that through the lens of the Department of Government Efficiency, or DOGE.

What Is DOGE?

Originally known as the U.S. Digital Services (founded in 2014), the agency was created to prevent conflicting or unintended regulatory consequences across federal departments. It was effective, so much so that many agencies reportedly hated it.

In recent years, it was rebranded and repurposed under Elon Musk, with a bold new mission: save $2 trillion in federal spending.

Let’s look at how that turned out.

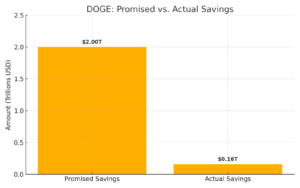

The DOGE Report Card: $2 Trillion Promised, $160 Billion Delivered

Despite the grand ambition, DOGE has only saved $160 billion, just 8% of its target. Even that number doesn’t account for the unintended consequences.

Staffing buyouts, rehiring, court rulings, and litigation have driven costs back up. In many cases, these costs outweigh the savings, and they certainly reduce public trust.

The IRS Example: A Dangerous Trade-Off

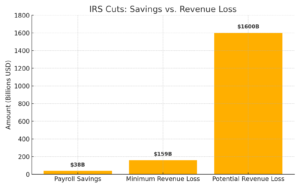

DOGE’s biggest target was the IRS. The result? A 31% reduction in auditors, 3,600 specialists lost, including many new hires still in training.

Why it matters:

-

Less effective tax enforcement

-

More high-income tax evasion

-

Reduced revenue

-

Declining confidence in the tax system

Research shows that when people believe others are cheating, they’re more likely to cheat themselves. The issue isn’t just about tax rates, it’s about whether the system feels fair and enforceable.

Let’s look at the numbers:

-

Short-term savings from salary cuts: ~$38 billion

-

Long-term projected revenue loss (Yale Budget Lab): up to $1.6 trillion

That’s just one department. The math doesn’t lie. Cutting corners with the IRS costs us far more than it saves.

The Newark Airport Debacle

The chaos at Newark Airport is a symptom of deeper dysfunction: years of underinvestment in the FAA and critical travel infrastructure.

The result?

-

Delays and disruptions

-

Frustrated travelers

-

Billions in economic losses

We didn’t save money, we shifted the cost onto the public and the economy.

Undermining Data, Undermining Policy

DOGE’s cuts also reached key statistical agencies, including:

-

Bureau of Labor Statistics (jobs, inflation)

-

Medical Expenditure Panel Survey (healthcare)

Consequences include:

-

Degraded economic forecasting

-

Unreliable inflation and employment data

-

Poor policymaking driven by incomplete information

It’s like trying to fly blind, without instruments, just to save a few bucks.

Government ≠ Business

Many assume government should run like a business. While leadership principles apply, public systems are far more complex.

Musk’s failure to address the most bloated, outdated systems, like the defense procurement process, points to a missed opportunity. Instead, focus was placed on areas that actually run relatively efficiently.

DOGE’s Legacy: What’s Left Behind

So what do we have?

-

Minimal net savings

-

High unintended costs

-

Public disapproval

-

A defense project (Golden Dome) that raises serious conflict-of-interest concerns

DOGE’s experiment has shown us this: meaningful reform must be strategic, not sensational. Cutting for the sake of cutting rarely works. If you want reliable services, you have to fund them accordingly.

Final Thoughts for Investors

This all ties back to your investment strategy.

-

Slashed funding affects market performance

-

Inaccurate data distorts economic indicators

-

Weak enforcement alters the tax landscape

-

A weaker dollar hits global buying power

At Avion Wealth, we help high-net-worth investors see the big picture and respond wisely.

If you’d like to talk about how these shifts affect your financial plan, we’re here to help. Until then, we wish you investing success.

Resources

Financial Times: Elon Musk’s painful departure

The Economist: DOGE comes for the data wonks

Investment News: As tax day comes, implications of Trump-era IRS remain murky

Politico: DOGE is at DOL: Here’s why that matters for the US economy.

The Nation: DOGE Is Wreaking Havoc on Everything—Except the War Machine

Reuters: Exclusive: Musk’s SpaceX is frontrunner to build Trump’s Golden Dome missile shield

Paul is the founder and CEO of Avion Wealth, LLC. He leads a team of wealth managers in building and executing financial plans for high net worth individuals and families. Contact Avion Wealth to speak with a financial advisor.